Rethink Wealth

Cash Flow Management

We take a pragmatic approach to managing cash flow. We understand your life isn’t static, and know your finances aren’t either. That’s why we focus on the prevention of “lifestyle creep”, maximizing savings, and making it simple so we can help you be confident in the plan for your future.

U.S. Households With Less Than $1,000 In Savings*

Think Managing Cash Flow Is Easy?

THINK AGAIN

U.S. Households Living Paycheck To Paycheck*

Median U.S. Household Savings*

NFL Retiree 2-Year Bankruptcy Rate*

The Truth Is..

SPENDING

MONEY

Is In Our DNA..

At the core of our DNA lies an inherent inclination to engage in financial transactions and allocate resources. The act of spending money is deeply ingrained in our nature, driving our desires, aspirations, and daily choices. Understanding this intrinsic connection allows us to navigate our financial landscape with greater self-awareness, empowering us to make intentional and informed spending decisions that align with our values and long-term financial goals.

We're 'Hard-Wired'

FOR INSTANT

GRATIFICATION

From A Young Age..

Scientific research has shown that our brains are wired to seek instant gratification from a young age. Studies have revealed that the prefrontal cortex, the part of the brain responsible for decision-making and impulse control, is not fully developed during child and adolescent years which is where many scientists and psychologists believe the relationship with money is primarily formed.

By understanding this , we can better comprehend our natural propensity for instant gratification and proactively work towards building financial discipline and making informed choices for our future well-being.

We're Constantly

Overwhelmed

With Opportunities To Buy

In our consumer-driven society, we face countless opportunities to make purchases, enticing us to buy unnecessary items. Surprisingly, studies reveal that we’re exposed to over 5,000 advertising messages daily, making it harder to resist the allure of constant consumption. This can lead to impulsive buying and financial decisions misaligned with long-term goals. Developing mindful spending habits and understanding the impact of advertising is crucial for financial well-being. Not to mention, with Americans contributing about 70% of GDP and spending an average of $12,000 annually on consumer goods, it’s vital to prioritize financial health amid the pervasive culture of consumption.

An Eventually..

We Give Up..

& Give In..

To The Status Quo

As social beings, humans have a natural inclination to conform and follow the status quo, often driven by the desire to fit in and “keep up with the Joneses.” This tendency stems from a need for social acceptance and the belief that acquiring material possessions or achieving certain lifestyle markers will lead to happiness and fulfillment. However, it is important to recognize that blindly chasing societal norms and materialistic pursuits can lead to financial strain and a misalignment with our true values and priorities.

We Spend Our Money

AS FAST AS

We Make It..

As Humans, we possess a natural inclination to spend money as quickly as it is earned, often driven by the desire for immediate gratification and the belief that material possessions bring happiness. This tendency can lead to impulsive buying behaviors, financial instability, and a lack of long-term financial planning. Recognizing this inherent inclination and developing disciplined spending habits can help individuals achieve a healthier financial outlook and work towards long-term financial goals.

Two critical steps in stopping this are creating awareness to the way we think and feel about financial resources, and implementing unconscious savings mechanisms.

Every Month

We Rinse..

& Repeat..

This Endless Cycle

Despite knowing the importance of budgeting and controlling our spending, humans often find themselves succumbing to impulsive buying behaviors and overspending. This can be attributed to various psychological factors, such as emotional triggers, societal influences, and the allure of instant gratification.

Understanding these primal tendencies and developing strategies to overcome them, such as creating an intentional budget you can follow, practicing mindful spending, and seeking support from financial professionals, can help individuals regain control over their finances and make more conscious and informed spending decisions.

Until there's nothing left

to build a future..

But what if there was a way..

To rise up above the noise and win..

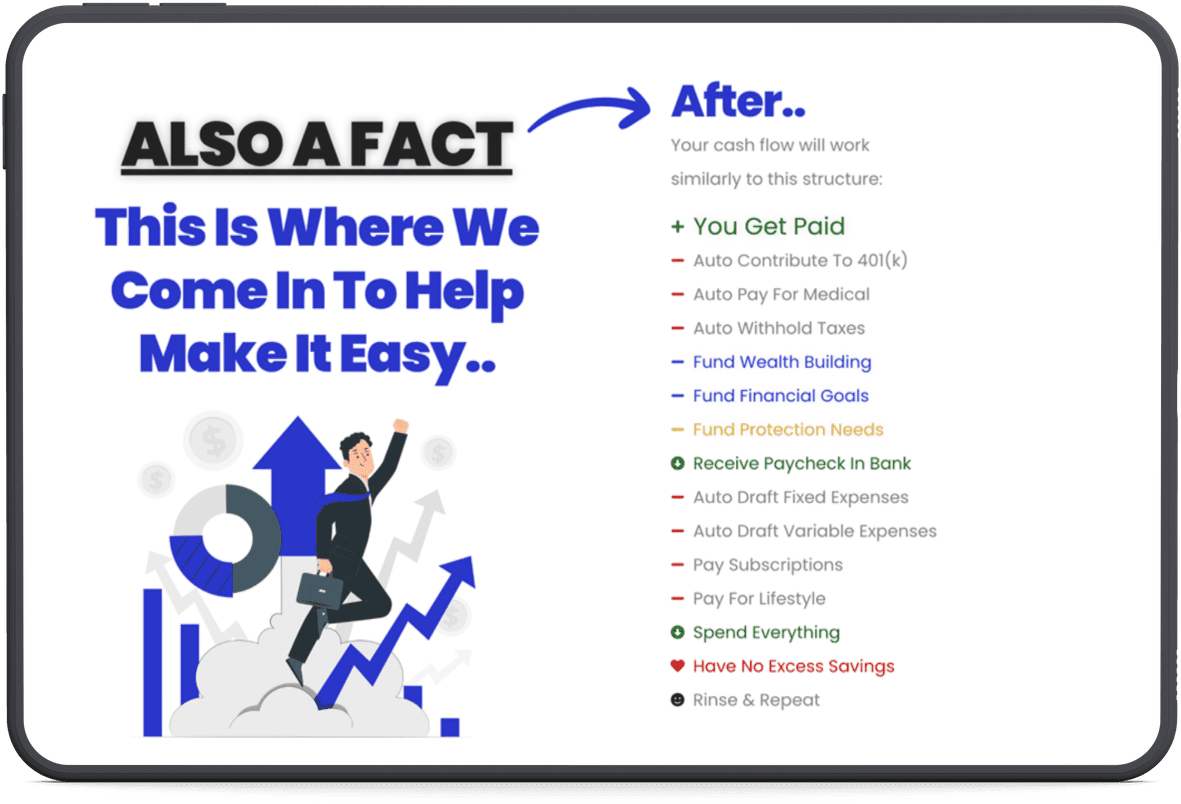

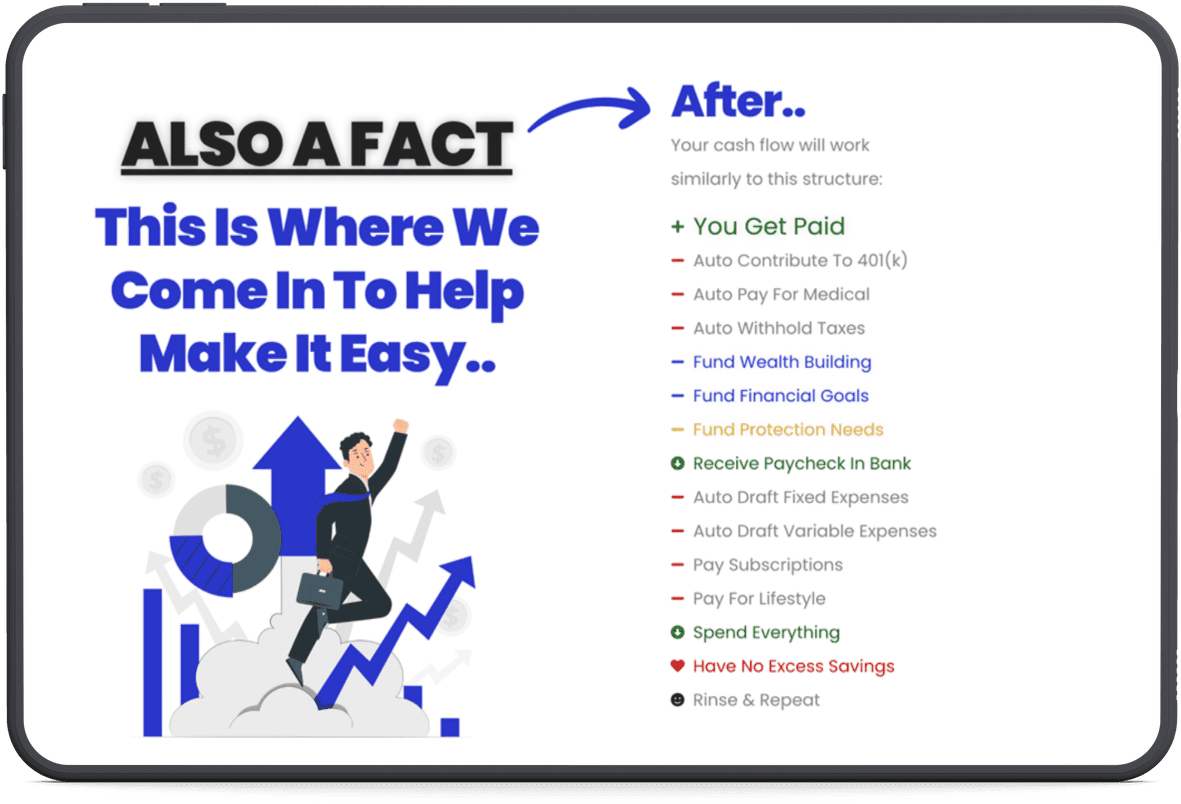

Here's How We Help

Manage Cash Flows

We understand there's a lot to keep up with, that's why our focus is on creating intentional and automated savings. We call this approach "Winning By Not Losing" and "Paying Ourselves First". When you reallocate unconscious spending to unconscious saving the gap between you and your financial goals can shrink quickly.

- Reduce Unwanted & Unconscious Consumption

- Automate & Reallocate Consumption To Savings

- Maintain A System For Building Long-Term Wealth

01

The first step in becoming a 'world-class saver' and reclaiming your financial independence is establishing your goals.

- Every financial goal should be a S.M.A.R.T. goal..

- Every goal should have a specific plan to achieve it..

- Saving for goals should come after saving for emergencies..

Choose Your Baseline & Set Your Target

02

Determine Your Baseline

Depending on your financial, personal, and professional goals you’ll establish a target savings amount that serves as the foundation for all future planning and activities. If you set it too high, your idle cash can be eroded by inflation.. If you set it too low, you may suffer from lost opportunity costs.

Start Filling Your Reservoir

03

Begin Building Momentum

After you’ve set up your Wealth Building Account with your financial professional or advisor you’ll begin to see your financial momentum start building. Keeping your targeted monthly savings automated is a great way to “set it and forget it”, which along with help from your financial advisor or professional, can help ensure your financial discipline over the long-term.

Make Your Move.

04

Put Your Money To Work

Once your target savings goal has been hit, you’re ready to start putting the excess accumulated cash to work for your future. By the time you reach this first milestone, you will have already pre-determined where it should go. You’ll know why it’s going to the places it is, and be able to work with your financial advisor or professional to see in real-time how it impacts progress towards your goals.

Maximize Your Potential

05

Make Disciplined Decisions

Once your target savings milestone has been achieved, you get to decide where and how to allocate it. Already having these funds prepared to be put to productive use makes the decision to save it even easier.

Every month you save over your target savings amount is a month you get to choose how to progress towards your goals.

When “life happens”, you’ll be able to access your cash reserves quickly if you need them with confidence that even if you have to use it for an emergency you’ll still be on track towards your goals..after all that’s what it is there for.

Rinse & Repeat

06

Effortlessly Stay On Track

It’s really that easy. It’s really that simple, and that’s why it works. When you focus on “winning by not losing”, “paying yourself first”, and bringing it all together with an automated solution.. saving gets a whole lot easier.

Plus you’ll be able to live and plan your life more confidently knowing that you’ve got an arsenal of tools, techniques, tips, and tricks behind you, supporting you every step of the way.

Discover Your

Potential

Apply now to submit your application to become a client, you will receive a response from our team within 48 hours to notify you of next steps. If you're still not quite ready yet, click 'Learn More' to discover how we use powerful tools to help us understand how you think and feel about money when assisting you with your financial planning using Financial DNA®.

Guardian considers someone who saves at least between 15%-20% of their income to be a World Class Saver