Behavioral Discovery & Coaching

Get An Advantage In Managing Your Behavior

The truth is that as humans, we're a lot less capable of controlling our emotions and the behavior caused by those emotions than we think. In the financial world, it can become a roadblock to your success. At Rethink Wealth we thoughtfully help clients remove what's holding them back from their potential.

How You Think And Feel About Money Likely Impacted Nearly Every Financial Decision You Could Possibly Make..

A COMPLEX & COMPLICATED SYSTEM

Most Of What We Know About Money Is Learned.

Something important to know about money is that it is a construct of human imagination. It has no internal value other than what a collective human consciousness gives to it, but is essential to the way our world works today.

Without the construct of money in our world, we would be forced to barter and trade physical goods with a "what you see is what you get" approach. Because the utilization of money is a figment of imagination people must be taught how to use it, the problem with this is that not all teachers are the same..

We Learn About Money From Our Own Personal Experiences With It, Good or Bad.

We Learn About Money From Other People's Experiences With It, Good or Bad.

DEVELOPED IN OUR FORMATIVE YEARS

By The Time We're 10 Years Old, We've Formed Most Of Our Relationship With Money.

Unless you've had behavioral coaching in your life since you were a toddler, it's very likely that you picked up some adverse, negative, or detrimental ways of thinking or behavior habits that you still continue today. Unfortunately for most people, these types of effects do not help them have better relationships with money and it's purpose in their lives.

This can lead to things like someone who did not grow up wealthy never being able to build wealth, because they don't believe they can.. or even lead to someone who grew up very wealthy to believe that their wealth provides them a certain status, which can impact behavior.

There Are Millions Of Possible Financial Scenarios That Can Impact Our Thinking & Behavior With Money.

What's Important Is To Start Exploring The Events That Have Occurred In Your Life That Have Shaped You.

MOST LIKELY NEVER TO BE REVIEWED

Events, Attitudes, & Experiences Continue To Shape Our World View On Money.

Over time, the moments, experiences, victories, and traumas accumulate and form a complex network of biases also known as heuristics which are automated shortcuts for decision-making. They're designed to help prevent us from being overwhelmed by the constant sensory overload and analysis of things happening every minute, hour, and day of our lives.

Unfortunately, our "saved" or "auto" responses aren't always correct, accurate, or even self-serving. In many instances they can be (and often are) detrimental to financial decision-making.

Emotional decision-making is often attributed as the biggest factor in why investors do not outperform the index on average.

One of the biggest hurdles to improving behavioral decisions is that for many, there was no formal instruction to learn it.

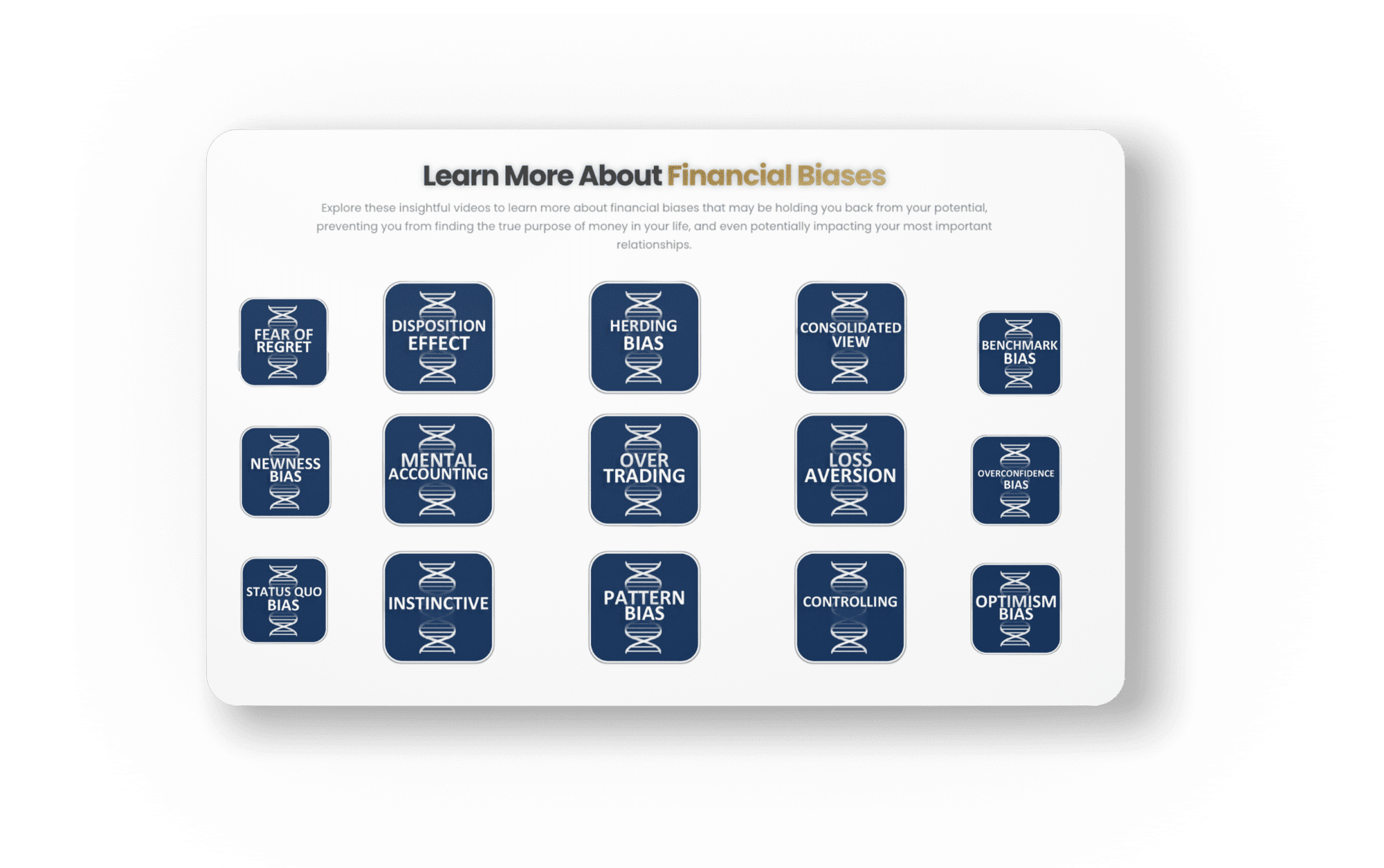

Discover Your Financial Biases

Delve into the fascinating world of understanding our own biases when it comes to money. We will explore the tendencies and thought patterns that can influence our financial decisions, helping you gain valuable insights and make more informed choices about your finances.

Our aim is to provide this understanding in a clear and accessible way, making it relatable and relatable for anyone, regardless of their financial background or experience.

Get Help Bridging The Gap Financial DNA®

Financial DNA® is a powerful tool that uncovers your unique financial personality and preferences. By utilizing a comprehensive assessment, Financial DNA® reveals insights into your natural strengths, communication style, risk tolerance, and decision-making approach when it comes to money.

This innovative tool helps you gain a deeper understanding of your financial behaviors, enabling you to make more informed and confident financial choices that align with your individual needs and values.

Whether you're an investor, advisor, or business owner, Financial DNA® empowers you to navigate the complexities of finance while staying true to your authentic self.

What's Holding You Back?

Start your journey towards financial self-awareness and take control of your financial future.