Individual financial planning

Achieve Financial Balance

Learn how to tell financial fact from fiction, plan your financial life holistically, increase your financial confidence, and achieve financial balance with The Living Balance Sheet®

INTRODUCING

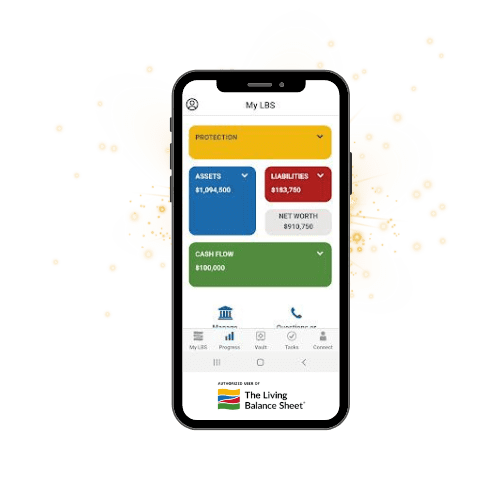

The Living Balance Sheet®

The Living Balance Sheet software is a powerful financial tool that provides a comprehensive view of your financial life in one place. It enables you to track, analyze, and optimize your assets, liabilities, income, and expenses, empowering you to make informed decisions and achieve financial balance.

Monitor & Track Financial Goal Progress In Real Time

Stay On Top Of Priorities With Interactive Guides

Keep All Of Your Important Documents Secured & Safe

It Helps You Create A Plan

Built Around You

The Living Balance Sheet® is more than just financial planning software, it’s “living and breathing”, which means you can understand where you’re at on your journey at any time, test and explore cash flow scenarios to determine how to spend less or save more, model debt strategies to see the impact of decisions to pay things off sooner or invest instead, and always make sure there’s no holes in your plan to provide for and protect your family in the event something happens to you.

Understand Where You Are On Your Wealth Building Journey.

Explore Cash Flow Scenarios To Determine How To Save More.

Model Debt Strategies To Determine Financial Impact.

Stress-Test Your Protection Plan To See If It Works As Intended.

It Can Help You Protect Your Todays

Why Protection First? Protecting your todays should be considered before your tomorrows are. You never know when life might change its mind. Having optimal protection in place will give you the stable financial foundation that you deserve.

We'll help you discover your real value and protect it for life.

Become A World-Class Saver

Why become a World-Class Saver? Being a great saver lets you look to your future with the financial confidence that things will work out just fine. Now that your protection is improving, it's time to focus on building up your balance sheet. It's a fact that the amount you save each year is much more powerful than chasing investment rates of return, and it's something you can control.

Keep Your Plan On Track

Why prepare for Life Events? Remember, life doesn't give you a heads-up about a change that's just around the corner. Becoming a world-class saver gives you more choices. Your new financial journey allows you to create a solid layer of wealth that is both protected and available. Money that you can count on being there when you need it most. So, it's always a good idea to maintain balance between your liquid assets and other long-term financial strategies.

Start Living Debt-Free

High cost consumer debt is a destructive force and can greatly affect your wealth building results. If you had a choice between your credit card company or your family, who would you choose? There are ways in which debt can be eliminated permanently from your financial picture without leaving you exposed in the meantime.

Knowing when to handle short-term debt is equally as important as not having it.

Let's Get Started

What Are You

Planning For?

The Living Balance Sheet® can help you plan for nearly every financial life event you can run into. While there are too many to list, these are some of the most common plans people start with first.

College Costs

Retirement Risks

Unplanned Events

What's Your Financial Balance Score?

Explore The Living Balance Sheet® and get a complimentary financial balance score.

The Living Balance Sheet® (LBS) and the LBS logo are service marks of The Guardian Life Insurance Company of America (Guardian), New York, NY. © Copyright 2005-2023 Guardian.

Guardian considers someone who saves at least 15.00%-20.00% of their income to be a “World-Class Saver”.

The above referenced graphics are taken directly from The Living Balance Sheet® and is the intellectual property of The Guardian Life Insurance Company of America. © Copyright 2005-2023 Guardian.